IEC (Code) Registration Process

January 17, 2019 by Tanya Sharma

The applicant needs to file an online form with all the required details and documents, make payment and submit it to the Directorate General of Foreign Trade. Once verified, you will get your Importer-exporter-Code within 10 working days.

What is IEC?

Importer-Exporter-Code is a mandatory registration for traders who are into import/export of goods. It is a 10-digit numeric code which is required by the Customs Authorities at the time of clearance.

Without this license, traders are not allowed to import/export anything outside India.

The IEC Code is also required when an importer sends money abroad through Bank; an exporter receives money in the bank account or is sending shipments at the Customs Port.

IEC Registration Process in India

Though the entity can register for IEC Code himself but, it is always better to take professional help so that the application and documents are filed correctly.

To initiate the registration process –

- File an online form (ANF 2A) with all the necessary details and upload documents wherever required.

- Make payment through Electronic Fund Transfer. ( if filing online)

- Submit the application and print it for future purposes.

- The concerned authorities will review the application and issue an IEC code on the name of the applicant.

Only selective bank payments are accepted through online mode which includes HDFC Bank, ICICI Bank, State Bank of India, UTI Bank, Punjab National Bank and Central Bank.

For applicants who do not have a debit or credit card can submit the fee through TR-6 Challan. In case of manual applications, the applicant needs to save a copy of it in MS-Word format.

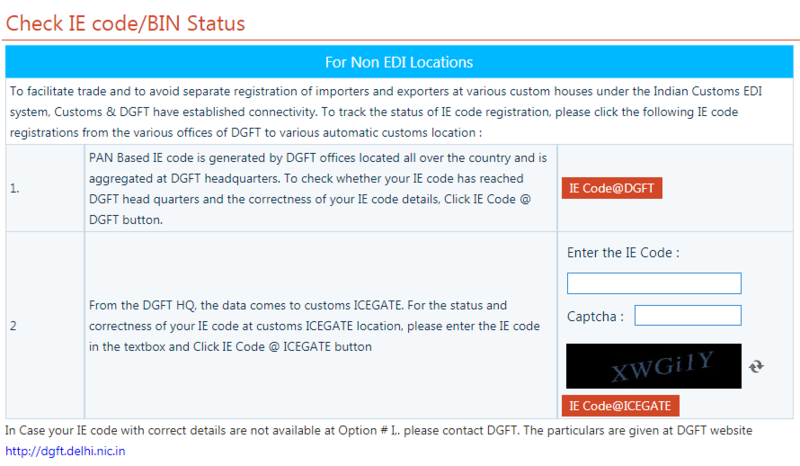

You can also check the status of your application online by clicking on the options provided.

Bonus Points

- All the documents are verified by the concerned authority for authentication. If any of the information is incorrect/false, the applicant is liable for penal or criminal action.

- The documents need to be uploaded in GIF/JPEG format with a size not more than 5 MB.

- PAN Card is not necessary in LEC Registration now.

- An auto-generated rejection letter/e-mail is sent to the applicant if the application is rejected/not-eligible for registration.

- GSTIN will be used as an Importer-Exporter-Code if a trader is registered under GST.

- LE Code registration is permanent in nature and does not require any renewal or annual compliance.