Import Export License: Documents, Process and Govt. Schemes

January 15, 2019 by Tanya Sharma

Import Export License is a 10-digit numeric code which is used in International Trade transactions and import-export of goods from/to India to another country. You can apply for the license online on the Directorate General of Foreign Trade portal.

What is Import Export License?

Registered or unregistered businesses have to obtain an Import Export License in order to transport goods to/from India into other countries. The Govt. of India has initiated the registration of Import and Export License online which makes it easier for the applicants to file the application and attach required documents.

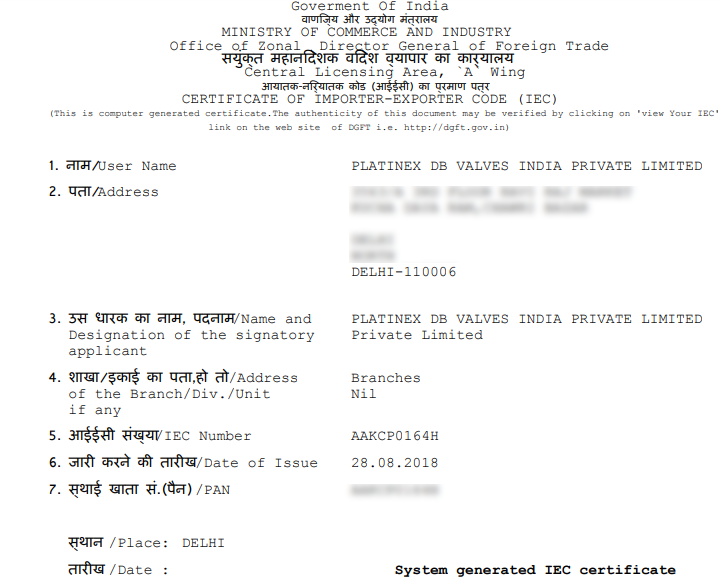

This license is issued by the Directorate General of Foreign Trade in the form of a digital certificate. The issuance of the license can take up to 5 working days however; usually if all the details mentioned in the application are verified to be true then it does not require much time.

As a trader, you would require your Import Export Code at the -

- Customs Authorities.

- When an importer sends money abroad through the Bank.

- When an exporter is sending shipments at the Customs Port.

- When an exporter receives money directly in the bank account.

You can also file manual applications at the concerned Regional Office which falls in your area. In this case, you need to save a soft copy of the application in MS-Word format.

Documents Required

The applicant needs to submit scanned copies of all the documents along with the prescribed form on the DGFT online Portal. The required documents are –

Address

Proof

Business

Proof

Sale / Purchase

Bills

Identity

Proof

- Applicant’s Identity Proof.

- Cancel Cheque Copy of the present bank account.

- Business Address Proof.

- Business Registration Proof.

Some additional documents are required to be submitted in case the applicant needs to make any changes (in the details) after registration of the license. It may also depend on the type of Business Registration.

All the documents need to be submitted in a file format of GIF/JPEG of not more than 5 MB. A legal/criminal action can be taken against the applicant for providing false/incorrect details.

Registration Cost in India

The Govt. fee for filing a fresh application is Rs. 500 which can be paid either through Demand Draft or Electronic Fund Transfer (EFT) TR 6 Challan.

TR 6 Challan is a manual/offline option of making payment for those applicants who do not have a debit/credit card. However; it should be submitted in the branches of Central Bank of India only.

You would require paying a professional fee if you authorise an attorney or agent to apply to your part. Quick Company, a legal registration company offers step-by-step guidance during the complete registration process.

| Government Fee | Rs 500 |

| Professional Fees | Rs 2,965 |

| Goods & Service Tax | Rs 534 |

| Total Cost | Rs 3,999 |

*The professional fee is for preparing all the required documents and filing the application.

The applicant needs to pay a Government Fee of Rs. 200 to make any modifications/changes in the details of Import Export License after its registration.

Registration Process

The registration process for Import Export License is quite simple however; it is always safe to consult a professional attorney to refrain from filling incorrect form or details.

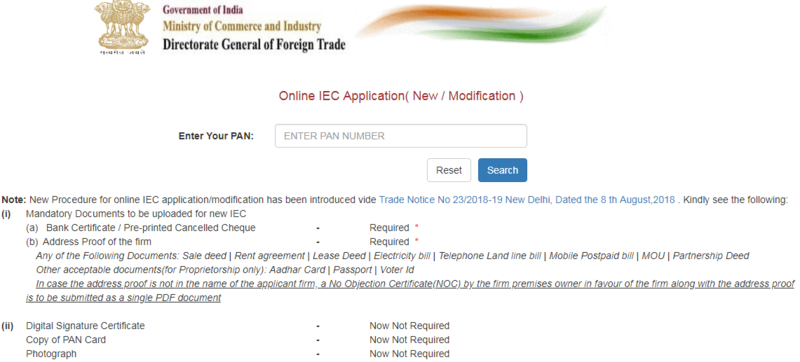

PAN Card is required to initiate the registration process of Import Export License.

The applicant needs to enter PAN details to proceed with the steps that follow.

- Fill an online form Ayaat Niryaat Form (ANF 2A) with all the necessary details and upload documents wherever required.

- Make the payment through Electronic Fund Transfer of acceptable banks.

- Once the application is filed successfully, you can print the application for future reference.

- The department will review the application and verify the same before issuing Import Export License.

You might also need to submit the form physically at the Directorate General of Foreign Trade office which falls under your business location.

The payment is accepted only through HDFC Bank, State Bank of India, Punjab National Bank, ICICI Bank, Central Bank, UTI Bank. Upon registration, the applicant will receive a link through SMS/E-mail to download and print the e-IEC Certificate.

Application Status

The Directorate General of Foreign Trade have established a connectivity which makes it easier for the applicants to track their applications and know the current status in the process.

To check the status of your application online click on any of the two options which will directly take you to the concerned platform for more information.

Benefits of Import Export License

Import Export License promotes international business in India and brings various opportunities for expansion.

- The Government can monitor transportation of illegal or prohibited import/export due to a standard registration process.

- Once you get the license registered on your name, you need not do any compliance.

- The Govt. of India has launched schemes like Merchandise Exports from India Scheme (MEIS) and Service Exports from India Scheme (SEIS) to benefit the importers/exporters while fee payment at the customs.

- Import Export license is valid for a lifetime and does not require any renewal or re-filing process.

Government Schemes

Under the Foreign Trade Policy several government schemes have been launched which offer different benefits to the importers/exporters of India aiming to promote International Business.

- Merchandise Exports from India Scheme provides incentives to the exporters in the form of freely transferrable credit slips which can also be used to pay service tax, excise duty or custom duties. These are offered at a foreign exchange rate of 2%to 5%.

- The Government also offers 3% to 5% of incentives to all the service providers who offer services outside India through the Service Exports from India Scheme.

- Duty-free Import Authorization Scheme allows duty-free imports of goods for which a minimum value addition of 20% needs to be fulfilled.

- You can also claim for the refund of duty on the products which are made out of duty paid inputs.

Changes after GST

Goods and Service Tax (GST) is an indirect tax which is applicable on different goods and services and is a combined form of Central and State Tax. After the introduction of GST in India, several changes came in acquiring Import Export License.

The Government of India has issued a notification stating that the Import Export Code would now be replaced by PAN/GSTIN, i.e. traders registered under GST need not apply for IEC registration separately.

GSTIN will now be used as an identifier at the transaction level for every import and export. In case GSTIN is not applicable, UIN (Unique Identification Number) or PAN would be accepted as Importer-Exporter-Code (IEC).

Also, for traders who are not registered under GST, their PAN would be considered as Import Export Code and will be used during import/export activities. You do not require an IEC in case the goods are exported or imported for personal use/purposes and not being used for any commercial activity.

IEC Exemption

No trader can import/export without getting the Import-Export License. However, there is a specific category which is exempted from IEC registration.

- Person importing/exporting goods for personal use with no relation with manufacturing or trading.

- Departments/Ministries of State or Central Government.

- Person importing/exporting goods from or to Nepal, Myanmar by Indo-Myanmar border or China where the CIF value does not increase from Rs. 25000 (single consignment).

- The exemption ceiling (applicable) is Rs. 1 Lakh in case of Nathula Port.

Bonus Points

- The Import Export Code is valid for all the branches, divisions, factories or units indicated on the Import-Export Code.

- You can send a written application to the Directorate General of Foreign Trade to issue a duplicate copy of the Import Export License in case it is lost or misplaced.

- The trader needs to surrender the license if he/she does not wish to use the license. In this case the concerned department needs to inform about the same to the Customs Authorities, Licensing Authorities and the Reserve Bank of India.

- The trader is eligible for various rebates on customs duty, service tax and shipment charges during the import/export of goods.

- According to the latest changes, Digital Signature Certificate (DSC), applicant’s photograph and copy of PAN Card are not required any longer in the registration process.

- The trader needs to update any of the changes made in the details after registration in the ANF-1 (Hand Book of the Procedure) containing the details of all the applicants or importer/exporter.

- All the documents must be enclosed in a self addressed envelope with a valid postal stamp to the concerned Regional DGFT office if you are sending them by Speed Post.

- On submission of the complete application, the issuing authority (DGFT) will send an auto-generated e-mail to the applicant intimating regarding the allotment of IEC.