Essential Features of a Company

September 24, 2018 by Akshara Bala

The Companies Act of 2013 states that a company is an entity that has several unique features; here are a few essential characteristics that have been described under the Act.

The Companies Act of 2013 replaced the erstwhile 1956 Act, giving a comprehensive approach to laws and regulations governing all listed and unlisted companies in India. Under the Act, the characteristics of a company have been examined and described in various provisions. Following are the salient features of a company:

Separate Legal Entity

In the eyes of the law, a Company is a distinctive and independent person – meaning, it has an identity of its own.

- The identity of the company is not linked to the members, directors or owners of the company.

- The company is responsible for its own actions, and the members, directors and other stakeholders can’t be held liable for the actions of the company (and vice versa).

- This company’s distinctive character is referred to as ‘juristic personality’, where the company is seen as a separate legal person separate from the founders who constituted it, the shareholders who own it, and directors who manage it.

- This distinctive identity allows the company to enter into agreements and contracts, and conduct business in its own name.

Perpetual Succession

“Men may come and men may go, but the company goes on forever.” Since the company is seen as a separate legal entity, it is not dependent on a member, owner or director for its existence.

- The survival of the company is not affected by the change in the management or the shareholding pattern. Irrespective of any variation in the shareholder pattern and management, the company will continue to enjoy its legal character.

- The retirement, death, lunacy or insolvency of any of its members or directors will have no effect on the lifespan of the company. So, what happens to the company when a director dies? Upon the death of the director, two things can happen.

- The holdings of the director (if any) will be transferred to his/her beneficiaries.

- The surviving Board will pass a resolution to appoint another director in his/her place.

If the director was the sole director of the company, then the remaining shareholders can elect a new director.

If the director was the sole director and the sole shareholder of the company, the beneficiary who inherits the deceased director’s shares can elect a new director for the company.

Common Seal

The company is an Artificial Person; therefore it cannot sign on its own. For this reason, the concept of the common seal was created. Under the provision of the Companies Act, the common seal is the official signature of the company.

- When the common seal of a company is administered on any document, it binds the company to the obligations mentioned in the same.

- The common seal of the company is typically affixed in the presence of the Board of Directors. The Act also specifies the minimum number of directors and company officials to be present while administering the common seal.

- The manner in which it is to be administered is defined in the Articles of Association of the company.

- Just like a person cannot have two signatures, a company can have only one common seal.

- By way of the common seal, a company can authorise a person to hold the power of attorney to execute deeds on its behalf. Any such deeds executed by the holder of the power of attorney will be binding on the company.

While the pervious acts recognised the use and significance of the common seal, the 2015 amendment of the Companies Act has made the practice of using the common seal as an optional compliance on the part of the company.

Voluntary Association

One of the typical characteristics of a company is that it is formed by an association of people, who want to conduct commercial or charitable activities for the sole purpose of either making profit, or for the good of the society, respectively.

- The Indian laws state that a minimum of two members and two directors are required to start a private company.

- A minimum of seven members is required to constitute a public company, along with a minimum of three directors.

- Before the Act of 2013 was notified, a single person was not allowed to constitute a company. However, under the 2013 Act, a person can incorporate a One-person company as well.

Transfer of Interest/Holdings

The ownership of the company is held by its shareholders (members of the company). Not all members have equal ownership - their rights in the company are limited to the proportion of their investment in the company.

- The members’ investment in the company is made up of shares – this builds the share capital of the company. For instance, in a private company, the owner might have contributed INR 5,00,000 as capital. This might be divided into 50,000 shares of INR 10 each.

- The holder of the shares is free to transfer the shares.

- In the case of a private company, the owner can sell his shares to another in case he wants to dilute his ownership.

- In the case of a public company, the shares are listed in a stock exchange and can be freely traded.

- A company limited by guarantee is very similar to a private company limited by shares. So, the guarantor’s stakes can be bought by another.

Diffused Ownership

As discussed above, two or more members may come together to constitute a company. Members refer to the ‘owners’ of the company or the people who put money into the company. Directors, on the other hand, are the people who manage the company.

- In the case of a private company (other than a one person company), a minimum of two members (seven in the case of the public) is required to start a company.

- A maximum of 50 members is allowed for a private company. However, there is no such restriction on the members of a public company.

- Minimum member requirements support the fact that a single person cannot own the entire company. The only exception is of a one-person company, which is a type of private company.

- There can be no single owner for a public company, and the ownership is spread across several shareholders.

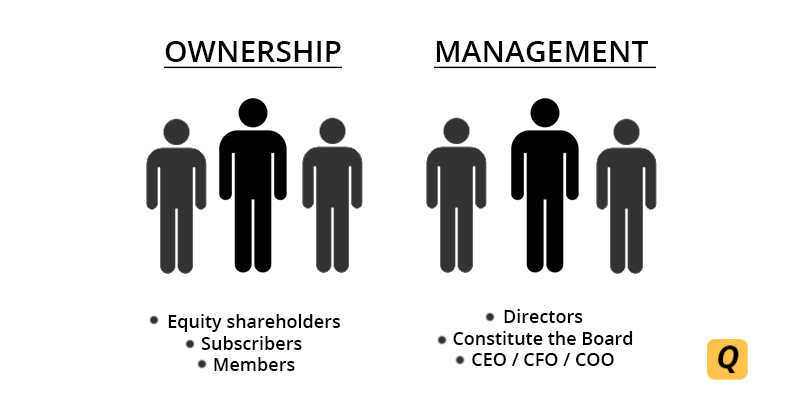

A Distinction Between Management and Ownership

In a partnership concern, the partners are the owners of the firm, and also have a say in the functioning of the firm. However, in a company, ownership does not give the right for the members to manage the affairs of the company.

- While equity shareholders are owners of the company, unlike a partner, they cannot have an active role in the company’s management.

- Elected representative(s) called the Director(s) of the company is in charge of the company’s management.

- All the directors of a company are collectively called the Board of Directors of the company. The board is collectively tasked with the day-to-day management of the company.

- A company cannot function without directors, and the Companies Act specifies the number of directors that each company must have/and is allowed to have.

- Under section 149(1) of the Act, the maximum number of directors in a company is 15 (additional directors can be appointed through a special resolution). A minimum of three directors is required for a public company. Two and one director(s) are required for a private company and one-person company respectively.

- In most cases, the founders of the company (founding shareholders) elect to be the directors of the company as well. However, there have also been instances where the founders chose to separate themselves from the management of the company.

- Typically the Board of Directors is made up of people who might also have an employment relationship with the company, for instance, Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, Company Secretary, etc.

- Additionally, listed companies should mandatorily appoint special categories of directors such as independent director, small shareholders directors, women director. A Listed company also has restrictions on the tenure of the directors.

Assets, Liability, and Holdings

Since the company is a separate legal entity, it can hold property in its name. Like an individual, the company can buy and sell a property, and can also take loans to make such investments.

Liabilities of Members

- The company will be entirely liable to meet such liabilities, and the members of the company cannot be responsible for the same.

- The members of the company are protected by ‘limited liability’. Meaning, the members can only be held liable to pay any amount within the scope of their unpaid shares (or the percentage of the guarantee undertaken by them).

- In case the company is in debts, and the member’s shares are fully paid-up, then they cannot be called to pay anything more. The personal assets of the members cannot be used to meet the creditors’ demands. The liability of the company cannot extend further to personal assets/finances of the members.

- For instance, if a person buys 1000 fully paid up shares of a public company for INR 23,00,000, he, as a member (shareholder) will not be liable to pay anything more. In an event of insolvency or bankruptcy, his risk is limited to losing those 1000 shares. However, in case the value of those share increase with time, he stands to gain, as the worth of his holdings will increase accordingly.

Assets and Liabilities of the Company

- Just like the company’s liability cannot be transferred to its members or directors, the company is not liable for the personal losses of its members.

- The company’s assets are its own, and cannot be taken as the personal asset of the director or member.

- The assets of the company can be liquidated to pay off the creditors of the company.

- In the case of winding-up of the company, any surplus assets of the company (after the creditors have been paid-off) can be distributed to the members of the company (in proportion to their holdings).

Artificial Person who can be Sued

The company is a ‘person’ in the eyes of the law, as in, it exists due to the constructs of the law. Since the company is its own legal person, the companies can be sued.

- The liabilities arising out of a lawsuit should be borne only by the company. This is referred to as the ‘Corporate Veil’, meaning, that the directors and the members of the company cannot be liable for the actions of the company.

- For instance, the person buys a car from a company and later gets into an accident due to some manufacturing defect. Who will be held liable? One can’t sue the owner, manufacturer, factory worker or the authorised dealer without knowing who the defaulter was.

- It’s much easier for a person to sue the company as a whole, and let the company answer for the actions of the people associated with it. In such cases, the company pays for the damages (if any) and then takes an internal action against the defaulter(s).

- The management of the company can enjoy immunity so long as they play fair and legal. The corporate veil can be pierced if the court finds evidence that a particular person has been responsible for the fraud, wrongdoing or illegal activity, which has led the company to act in an unlawful manner.

Voting Rights

The shareholders of the company (members) have certain rights vested in them by virtue of their equity investment.

- These rights include the right to know the financial status of the company and the right to have a share in the company’s profits.

- Amongst the significant rights is the right to vote, as defined under Section 47 of the Companies Act. This allows the members of the company to have a degree of control over the workings of the company and management.

- Under the provisions of the Act, all equity shareholders have the right to vote on the resolutions placed before the company.

- The voting right on the poll will be in proportion to the shares held by the shareholder. For instance, if any person holds 51% of the shareholdings, then he/she has major control of the resolutions passed.

- The Act allows the company to place certain restrictions on the voting rights of the shareholders and defines the same in the Articles of Association.