E-Commerce FSSAI License

November 25, 2021 by Bhawna Arora

Online businesses in India are developing on a high scale. More and more people are joining the online shopping market because of the easy availability of all kinds of products be it clothes, medicines, fruits, vegetables, home-based products, etc. As per the direction of the Food Safety and Standards Authority of India (FSSAI) all E-Commerce Food Business Operators (FBOs) must obtain a Central License from the Central Licensing Authority.

E-Commerce A Brief Outline:

E-commerce is an internet-based business activity that includes buying, selling goods or services, transferring money, etc. E-commerce is used to describe the sale of physical products through the online platform, and it can also include other commercial transactions done through an online source.

Business operators performing E-Commerce activities are covered under Section 3 of the FSS Act, 2006 and it is necessary to obtain FSSAI License for such businesses under the E-Commerce category. Such License shall be for the Head Office or Registered Office address.

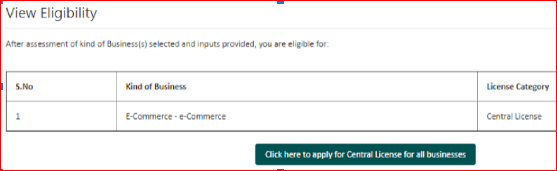

Generally, business operators are required to apply to FSSAI under 3 main categories. But for E-Commerce Business it is mandatory to obtain a Central License irrespective of its turnover. The annual fee for obtaining an FSSAI license for such a business is Rupees 7500.

Procedure to apply for FSSAI License by e-Commerce Business:

Step 1: Create a Signup or Login on the FSSAI online platform.

Step 2: Click on the option “License/Registration and Apply for License/Registration” on the left side of the page.

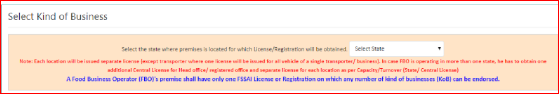

Step 3: Select the State through the drop-down menu.

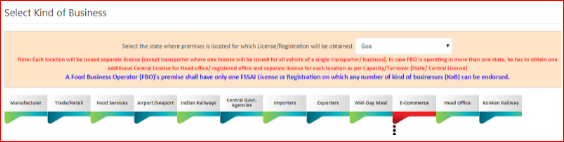

Step 4: Carefully read the instructions and select the option of E-Commerce from Group Heads.

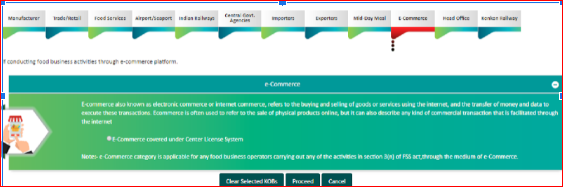

Step 5: Go through the definition of E-Commerce, click on the button "E-Commerce covered under central license” and then click on the "proceed" button.

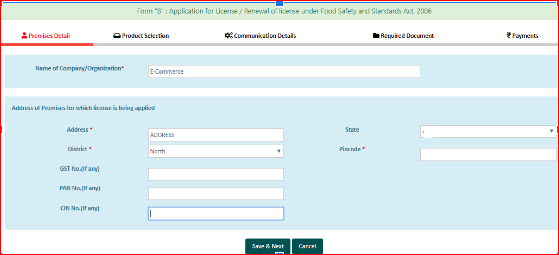

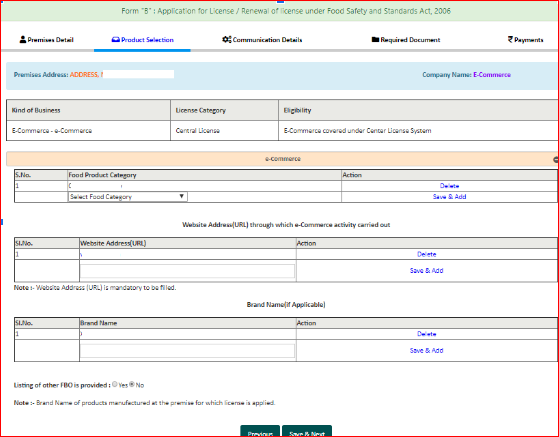

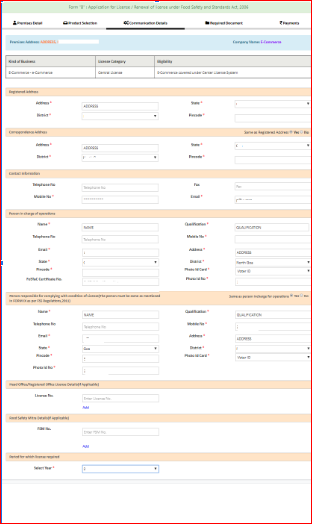

Step 6: Fill in all the details as mentioned in “Form B”. Provide GST/PAN/CIN No. as applicable and communication details must be filled in carefully as all sort of communication in this regard will be made to such Mobile No. or email id etc.

Step 7: Upload the required documents.

Step 8: Pay the statutory fee and then submit the application.

Step 9: After payment is completed, an auto-generated receipt with a 17-digit reference number will be obtained for future reference.

Step 10: The user can easily track the status of his application through such a such17-digit reference number.

Benefits of E-Commerce Business after obtaining FSSAI License:

E-commerce Businesses can enjoy the following advantages:

- Increased levels of confidence in consumers in regards to products and services offered.

- Easy market access for such businesses.

- Increased level of growth in business.

- Enhanced quality of products being offered to the consumer, which will impact the goodwill of the business in a positive way.

- The business can also expand and offer better quality products.

- Businesses can gain various legal benefits and also avoid penalties.

FSSAI Prescribed Standards for E-Commerce Business:

- FSSAI has provided that all Sellers/vendors/Manufacturers who display or offer any type of pre-packed food article for sale either on their own online platform or on a marketplace-based model of e-commerce, must provide a clear picture of the "principal display panel" of such pre-packed food.

- The food product must have a shelf life of 30% or 45 days before expiry at the time of delivery of such product by E-commerce FBOs.

- Proper safety of food products must be ensured at the time of delivery.

- All types of business operators selling their products through online platforms must display their FSSAI Registration No./ License No. and other mandatory information in regards to such food articles being sold through online platforms free of cost.