What is a Digital Signature Certificate?

January 24, 2019 by Tanya Sharma

The digital signatures of an individual prove the identity of the concerned person to sign the documents electronically. It is issued by a licensed Certifying Authority (CA) and is valid for 2 years.

A DSC holds information about the user’s name, e-mail address, country, pin code, date of issuance of certificate and name of the CA issuing the DSC. It proves the identity of the person and is legally acceptable.

When you use a DSC to file an e-form, it automatically fetches the required information which saves the hassle of entering the details manually. The Ministry of Corporate Affairs has made it mandatory to file all reports, applications and forms using a DSC only.

For example – You require a DSC to file Income Tax and GST returns.

In case of an encrypted DSC, a private key or code is to be entered to read the stored information.

You can use the sign only DSC in filing income tax, sign forms on MCA Portal and e-ticketing while Sign and Encrypt DSC is usually used for e-Tendering.

Types of DSC

The issuance of DSC depends on the type of individual or business filing for it. DSC can be filled under the following classes.

Class I DSC

This DSC is used to confirm basic details of the user like name, contact details, e-mail address and can be issued to both individuals and businesses. The same data is also stored in the Certifying Authorities Database for verification purposes.

This can be used when there are fewer chances of data compromises since it involves basic information about the applicant.

Class II DSC

If you are a director or have signing authority in a company, then you would require Class II DSC for e-filing purposes with the Registrar of Companies (ROC) or income tax department.

It can also be issued to sole proprietors to sign e-tax returns. Under Class II DSC, the identity of the owner can be verified against a pre-verified database.

Company Secretaries and Charted Accountants can also register themselves under this DSC type for filing company related e-forms. It involves higher data security.

Class III DSC

To obtain Class III DSC, you will have to appear in front of the Certifying Authority. This DSC can be issued to individuals and/or organisations for participating in online auctions and tenders.

Certified Authority is a person who has the license to issue DSC. You can get the information about such CA’s on the MCA portal online.

Benefits of DSC

Once registered, a DSC is valid for 2 years. Here are few of the benefits of the certificate.

- Having a DSC eases the complications of doing business online.

- It helps to reduce the time you would require to sign the forms or documents manually.

- Reduced changes of any fraudulent since all the information is verified from CA’s database.

- The documents or forms signed digitally cannot be altered or edited.

- It can be used to sign documents created in different formats (MS Office or PDF) and encrypted e-mails.

- For the purpose of tenders or procurement (online) and securing web transactions.

Documents required for DSC

All the documents for the registration can be submitted through online mode only. To apply for a DSC, you need a copy of the following documents –

Identity Proof

Address Proof

Business Proof

Photo Proof

- Identity Proof

- Address Proof

- Registration Proof (Business)

- Income Tax Returns.

DSC Registration Cost

Since the Ministry of Corporate Affairs has authorised different Certifying Agencies for DSC Registrations, they charge differently for it. There are no fixed charges for DSC Registration in India.

According to the MCA, DSC Registration cost will include the cost of the issuance and a one-time charge for the medium (USB token).

Quick Company, have minimal charges for DSC registration which also includes step by step guidance throughout the registration process.

| Type of DSC | Quick Company Fee |

| Class II | Rs.1500 |

| Class III | Rs. 3500 |

*We prepare the necessary documents and take care of the complete filling process on your behalf.

DSC Registration Process

Only Certifying authorities can issue a Digital Signature Certificate in India. The process takes about 2 working days to complete.

You need to follow these steps for applying for a DSC.

- File the prescribed form with all the required details and copies of supporting documents.

- An application number (for tracking) will be sent to your registered mobile number/e-mail post successful submission of the application.

- Once the application form is submitted successfully you will be asked to confirm the details through SMS and Video Verification.

- Once all the details are verified from the concerned authorities, a DSC will be issued on your name.

It is mandatory to perform a Video Verification process in order to confirm your details and get a DSC. You will get a link to make the video on your registered e-mail address.

The e-mail will provide different options to proceed for Video Recording through -

- Web Browser

- Android Application

- iPhone Application

Select the appropriate option according to your convenience and it will automatically take you to the authorized gateway. Complete the process which follows and submit your details after confirming.

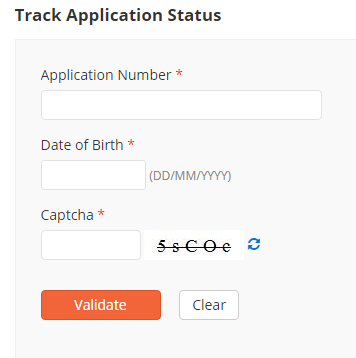

Application Status

The applicant can track the status of DSC Registration through the application number provided during the process. The Ministry of Corporate Affairs has authorized e-Mudra as one of the Certifying Authorities for DSC Registration.

You can either download the application or view the status on their online portal. The status reflected against the application refers to the different stages of the registration process.

Following status are reflected once the application is processed for registration –

- Mobile Verification

- Video Verification Pending

- Certificate Ready for Download

- Certificate Downloaded

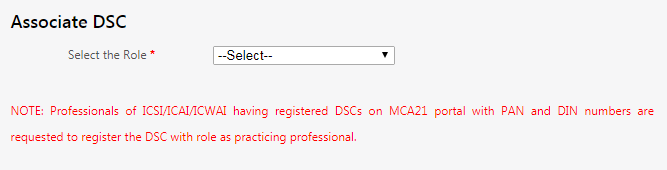

Link DSC with MCA

You must register your DSC on the Ministry of Corporate Affairs (MCA) portal if you wish to use it for filing e-forms or returns for your business. This step allows MCA to identify people using the DSC and know of unauthorised uses (if any).

- You need to visit the MCA portal and select ‘Associate DSC’ under MCA Services to link your DSC.

- Enter the required information in the fields.

- You will require uploading your DSC on the portal through MCA E-Signer. The link to download it will be available on the same page.

- After downloading MCA E-Signer, insert the DSC on your laptop/computer and enter the password required to link your details to MCA.

- Click on submit after completing the process. This will successfully link your DSC on MCA.

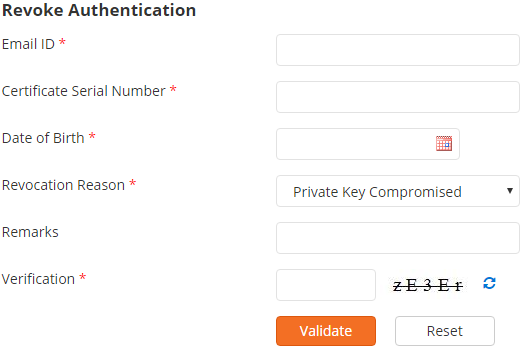

Cancel DSC

You can also cancel your DSC Registration if you do not wish to use it in the future or feel that the authenticity has been compromised. An applicant can also apply for the cancellation of DSC due to the following reasons.

- Private Key Compromised.

- Loss of Private Key.

- Any information in the certificate has changed.

- Transferred, Retired or Resign from the organisation (In case of DSC registered under Company)

- Death of the Subscriber.

- Dissolution of the Company.

You can file the request of Cancelling your DSC online through the E-Mudra portal and fill the necessary details to initiate the process.

DSC Renewal

To continue the use of DSC you need to renew the registration after 2 years. There is no process for DSC Renewal since you will have to file a fresh application and undergo the registration process again.

Once your DSC is renewed, you will have to update the same on MCA Portal as well. If you do not renew you DSC it will automatically get canceled.

Important

Citizens of other countries or Foreign Nationals/organisations can also apply for DSC in India. They would require following a similar process that goes for the Indian applicants. However; there are a few documents that may differ in some of the cases.

Identity Proof (All and attested)

- Copy of passport

- Copy of VISA

- Copy of Resident Permit Certificate (if residing in India)

- Copy of PAN Card (mandatory)

Address Proof (any one)

- Copy of attested passport

- Attested copy of bank/government issued address proof.

**All the documents in the case of foreign applicants must be notarized by the Public Notary and apostilled by the Governing Authority of the respective country.

Through the issuance of DSC, it bcomes easier to conduct business opreations even for foreign organizations and the data stays protected from any fraud or duplicacy.