What Does it Mean to be a Limited Company?

September 21, 2018 by Akshara Bala

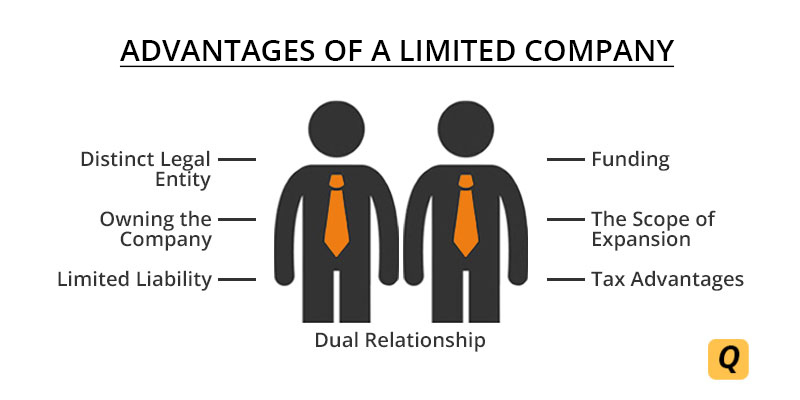

A limited company has a distinctive identity and is seen as an artificial person in the eyes of the law. The key characteristic being, that the finances of the company are completely separate from the finances of the owners, promoters, employees, and members. The financial responsibilities of the company are its own and the burden cannot be shared or passed on.

Limited companies are usually identifiable through the ‘Ltd’ abbreviation behind the company’s name. Limited companies are types of incorporations that are allowed under the Companies Act, 2013. These type of companies is recognised in several parts of the world like the UK, Canada, etc.

Functioning of a Limited Company

Limited companies function using capital invested in the company. This capital investment is made by the shareholders of the company, who can also be called members of the company. Upon insolvency, bankruptcy, or liquidation of a company, the personal assets of the shareholders cannot be used to meet the financial burden of the company. This is why the word ‘limited’ is used in the name of the company, it refers to the ‘limited liability’ of the company.

The company is created with a purpose of either conducting business, gaining profit or for charitable intentions. The activities of the company and relationship with its internal and external stakeholders are defined in the Memorandum of Association and Articles of Association.

Here is how a limited company functions:

- Holdings: A company has more than one member (also called shareholder or owner) who hold shares of the company. Shares are basically intangible units of capital and have a specific value. The share expresses the shareholder’s relationship with the company. The shares of the members constitute their holdings and are called the share capital of the company.

- Management: A company is managed by the Directors of the company who constitute the Board of Directors (Board). The Board is assigned with administrative and managerial tasks to ensure the smooth functioning of the company. Separation of the management from the owners ensures that capable individuals run the company. The directors are also employees of the company.

- Separate Legal identity: The Company is a separate legal person and has its own identity that is distinct and separate from its owners, shareholders, members and other stakeholders. The company can undertake business activities in its name, enter into agreements and purchase and sell assets.

- Perpetual Succession: Since the company has a distinctive identity, it is not dependent on anyone for its survival and existence. Despite the change in management or members, the company’s existence will be unaffected.

- Voluntary Association of people: A company is formed by a group of people who have a mutual interest and intention of starting the company. The objectives of the company will depend on these people. For instance, they can start a company as a non-profit educational institution.

- Responsibilities and Profit: The finances and tax responsibilities of the company are separate from their stakeholders. All the profits gained belong to the company, however, these profits can be distributed to the shareholders of the company in proportion to the shares held by them. This type of profit distribution is called dividend. Profits after tax and dividend payments are added to the working capital of the company and are used for its day-to-functioning.

Meaning of ‘Limited Liability’

The liability of the company refers to the financial responsibility that it must meet. A limited company is essentially said to have ‘limited liability’.

- In an event of insolvency, bankruptcy or debt of the company, the personal finances/assets of the owners remain protected, and they are not obligated to meet the liabilities of the company.

- The liability of the owners is only limited to their investment. In this case, their shares.

- Only unpaid shares held by the owner can be called to meet the debt of the company. If the shares are fully paid-up, then the obligation of the shareholders ends.

- The risk involved in a limited liability company is – the shareholders may lose the value of their shares in a case of the company’s insolvency. The company will not be in a position to pay back the shareholders.

Forms of Limited Companies

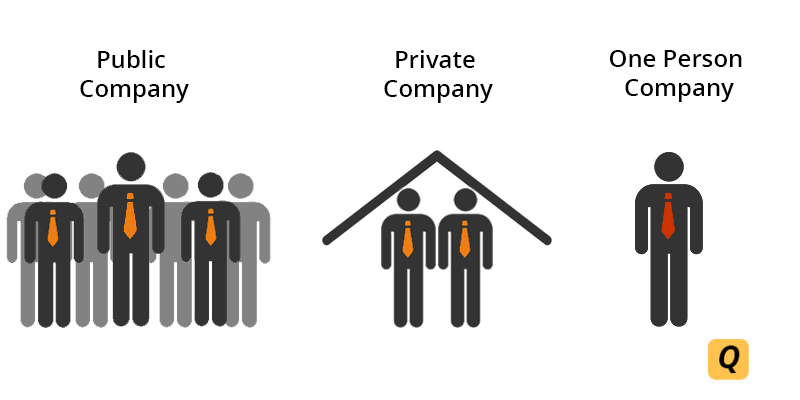

Most of the companies that we know today are limited companies, that is, they have limited liability. This is beside the fact that these companies can be private limited, public limited company or one person companies.

Examples of Limited Companies

For instance, in the USA, Google and Facebook are all LLCs. However, in India, they have been set up as private limited companies. Wipro and Infosys are examples of public limited companies. Apart from this, there are unlimited companies and limited liability partnerships. The members of unlimited companies are not protected by the ‘limited liability’ clause.

Limited Companies: Limited by shares or guarantee

A limited company can have is liability limited in two ways – by shares or by guarantee. The Companies Act, 2013 recognises both these models of operation. These companies function under the notion that it is a separate legal entity, and is responsible for its own actions. So, just as the company can purchase assets and enter into agreements, it is also responsible to clear its financial debts.

Limited by Shares

Businesses that function with the objective of making money are usually set up with shares. This is because the shares create a tangible value and also has the prospects of increasing in value. This can be beneficial for the shareholders.

- The members of the company hold shares in the company. These shares are allotted to the members based on their investment.

- Since the company is based on shares, the company is also said to be limited by shares. So the liability of the members is limited to the value of their shares. Debts of the company can be met by calling for the owners' unpaid share capital, and nothing more.

- Surplus profits (after allocating working capital requirements) gained by the company is distributed by the way of dividend in proportion to the numbers of shares held by the member.

- The shareholders also have voting rights, which allow the members to be part of the major decisions of the company. These rights are also issued in proportion to the members’ shareholdings.

- Through shares, the owner can sell, fully or partly, a portion of his/her holdings in the company.

Limited by Guarantee

A company limited by guarantee is not based on shares or share capital. This type of business model is most suitable for charitable and non-profit institutions. Here, the owners of the company are not looking to make a profit on their holdings and profits earned by the company through its activities can be reinvested into the company.

- The owners (members) of the company are called guarantors. This is because they fix a 'guarantee amount' that they would be liable to pay in the event the company needs to meets its debts. Therefore, their liability is limited by the guarantee amount specified by them.

- Since the members are not looking for monetary gain, no dividends are paid to the members. However, voting rights are based on the percentage of their guarantee.

- Such companies are usually endowment institutions and already are set up with a huge capital base to meets its working capital requirements. However, if necessary, the funding of the company can be boosted by raising capital through shares. If there is a share capital, the members’ liability will be limited to both the guarantee amount undertaken by them and the value of their investment in shares.

Types of Limited Companies

The most popular types of companies that have been limited by shares are public and private companies. The main difference between the two arises based on the category of people who can become the shareholders of the company. In a public company, the shares can be held by any member of the public. Whereas, the shares of a private company are held by a close-knit group of private individuals – such as the owner, his/her friends, relatives, etc.

Private Companies

The Companies Act describes this type of company as:

- One where the transfer of shares is restricted

- One where there is a limitation on the numbers of members

Minimum Capital requirement: Paid up capital of INR 1 Lakh

Minimum no. of members: 2

Maximum no. of members: 200

Minimum no. of Directors: 2

Characteristics of a Private Company

The companies Act restricts the number of members a private limited company can have. Additionally, the transfer of shares is restricted and trading of the shares to the public is prohibited.

- A private company is not listed in any of the national stock exchanges. The shares of the company cannot be traded and are only held by a group of private individuals.

- Unlike a public company that has various regulatory requirements, a private company does not have to meet requirements such as conducting statutory general meetings, issuing prospectus and securing the certificate of commencement.

- A private company can become public after going for an Initial Public Offering, after being listed in the stock exchange. To be listed in the stock exchange, the company would have to meet the requirements set up the SEBI (Securities and Exchange Board of India).

Public Companies

The Companies Act describes this type of company as:

- One where there's no limitation on the number of members

- One where the transferability of the shares is allowed without any restriction.

Minimum Capital requirement: Paid up capital of INR 5 Lakh

Minimum no. of members: 7

Maximum no. of members: No Limit

Minimum no. of Directors: 3

Characteristics of a Public Company

The shares of the company can be traded freely, and the value of the shares is based on certain market factors. Since the shares can be freely traded, the Act does not restrict the number of members that the company is allowed to have.

- The shares of a public company are listed in a stock exchange (like BSE / NSE) and can be traded freely by the public.

- The regulatory compliance requirements for a public company are much higher since a lot of public money is invested in the company. Therefore, disclosure and statements would have to be prepared by the company to meet the requirements set by the SEBI.

- A public company can be converted into a private company by buying all the shares of the members back. This is called buyback of shares. In such a situation, the company is removed from the stock exchanges. Apart from this, the company would have to reduce its holdings and capital as specified by the Finance Act.

|

Features |

Public Limited Company |

Private Limited Company |

|

Minimum number of members |

7 |

2 |

|

Minimum number of directors |

3 |

2 |

|

Maximum number of members |

Unlimited |

200 |

|

Minimum capital requirement |

5,00,000 |

1,00,000 |

|

Invitation to the public to purchase shares of the company |

Yes |

No |

|

The quorum required at AGM |

5 members |

2 members |

|

Certificate for commencement of business |

Yes |

No |

|

The term used as a part of the company name |

Limited |

Private limited |

|

Mandatory Statutory meeting |

Yes |

No |

One Person Company

The Companies Act describes this type of company as:

- One where the transfer of shares is restricted

- One where there is only one shareholder/member of the company

Minimum Capital requirement: Paid up capital of INR 1 Lakh

Minimum no. of members: 1

Minimum no. of Directors: 1

Characteristics of a One Person Company

The Companies Act, 2013 allows the incorporation of One Person Companies. This is a type of private limited company that can be incorporated as limited by share or guarantee, or be incorporated as unlimited.

- The name of the company should be followed by the term One Person Company.

- It is similar to the sole proprietorship model but has certain privileges that private companies have.

- While the company can have one shareholder and one director, just like any private company, the numbers of directors can be increased to a maximum of 15.

- A nominee is mentioned in the MOA of the company since there is only one member of the company.