Issue and Purchase of Shares by NRI

March 22, 2019 by Jaskirat Kohli

To issue and purchase shares in the Indian economy, NRI are allowed to invest in either Private Limited Company or Public Limited Company with the approval of Reserve Bank of India

NRI stands for Non-Resident Indian, but it can be classified into two categories;

- A person who does not resides in India but holds an Indian passport

- A Person of Indian Origin (PIO), a non-resident Indian having a foreign passport.

This is defined under the FEMA Act, 1999 where a Private Limited Company is the most simpler medium for the NRI or Foreign Investors to invest in a business in India.

Purchase and transfer of shares to NRI or person residing outside India

A person residing outside India may purchase equity or preference shares or convertible debentures offered on the right basis by a Private Limited Company or Public Limited Company, under specific conditions:

- The percentage of the Foreign Equity which is already approved or that is permitted under the FDI Scheme should not increase with the purchase of shares by the NRI.

- It should not exceed the sectored cap of FDI for the share.

- The purchase of stock should be by a person who is already staying out of India

- The amount of share cannot be less than that of the Indian shareholders.

Transferring shares under the following situations:

1. NRI to Indian Resident (General Permission)

When an NRI is transferring shares to an Indian Resident, it is possible as the Reserve Bank of India has given general permission for such transfers and it can be done by gifting it to a resident of India.

2. NRI to Person Resident in India (Consideration)

This transfer needs prior permission from the Reserve Bank of India, as the shares that are being transferred by a person who is residing outside of India to a person who is residing in India.

3. NRI to another NRI

The Reserve Bank of India permits to transfer of shares of a Company from one NRI to another NRI/PIO.

Automatic Route for Issue of Shares by an Indian Company

Under FEMA regulations, an Indian Company can issue shares under the automatic route to a person resident outside India. The following are some of the types of companies that can avail the automatic route of FDI:

- Manufacturing company.

- Trading company.

- Small scale industrial company.

- Export Oriented Unit or a Unit in the Free Trade Zone.

- Any other company.

Payment for Share Issued to NRIs or Foreign National

An India company issuing shares to a person resident outside India should receive the payment for the shares through one of the following routes:

- Inward remittance through normal banking channel.

- Debit to NRE/FCNR account of the concerned person should be maintained with an authorised dealer or bank in India.

What is the detailed procedure for Issuing and purchasing Shares by NRI and other foreign Nationals?

In the case of NRIs, they can also execute the transfer of shares via their demat accounts. Such transfer of shares from the demat account can either be for consideration or without consideration.

For all the foreign investments made by NRIs and foreign nationals, it is mandatory to file a report to the Regional Office of the RBI within 30 days from the date of receipt of the amount and also another report in FC-GPR for the acquisition of right shares and bonus shares.

Details of Foreign Development Investments are to be provided in Part A and B.

- Part A of the form which the Company has to file on its own, through AD Category-1 bank, to the concerned Regional Office of RBI.

- Part B, which consists of an annual report of all investments made by the company during a financial year has to be submitted directly by the company to the Department of Statistical Analysis & Computer Services, Reserve bank of India before 30th June every year.

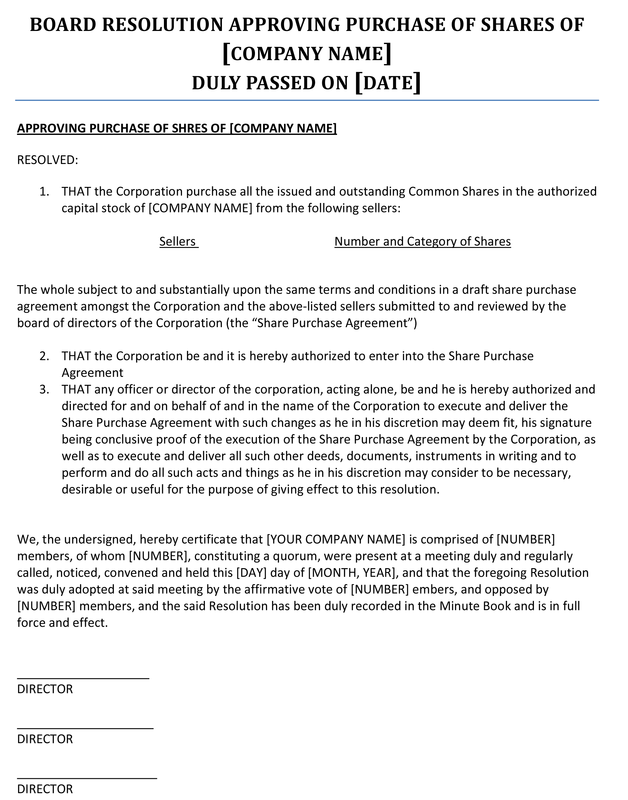

Here is the attached copy of the board resolution that needs to be filed for issuing shares :