One Person Company

April 12, 2016 by

One Person Company, the new form of business entity world widely known as OPC. In 2005, this revolutionary concept of OPC was recommended by the expert committee on company law under the chairmanship of Dr. J.J. Irani which was constituted by the government. For the first time, the new concept of OPC (One Person Company) has been introduced in India through the Companies Act, 2013.

Introduction of OPC

OPC is a new hybrid form of business which merges the qualities of Sole Proprietorship and company. With the introduction provide the opportunities to the young businessmen who are looking forward to start their own business venture with organised structure.

OPC = Sole Proprietorship + Company

According to section 2(62) of the Companies Act, 2013, OPC is a company which has only one person as a member. OPC (One Person Company) treated as a private company that means all the provisions applicable to private company also applicable to the one person company.

Through the concept of OPC, law recognized it as the formation of a single person economic entity. Such entity provides the simpler regime through exemptions so that an entrepreneur alone can form its business venture instead of trifle away his time and resources.

What is the need to introduce the OPC?

Before there is no concept of OPC (One Person Company) in Companies Act, 1956. With the introduction of Companies Act, 2013, the concept of OPC came into existence. So, Sole Proprietorship was the only form of business entity which allows to incorporate a venture with one member only. But, this form of business entity is not adequate with the dynamic business environment which erects the requisite to form a new business entity. The things which make both the entities different are:

- Unlike in sole proprietorship, OPC is a completely separate entity from its owner.

- The way and manner in which the liability is treated, creates the fundamental basic difference between both the entities. In OPC the liability is limited to the unpaid amount in the name of member while in sole proprietorship the owner has sole liability, hence his personal assets are also liable to the amount which will be made against the business.

- Regarding taxation, OPC is treated as private company because the new concept of OPC introduced in Companies Act, 2013 only not in the Income Tax Act, 1961. So, the income of OPC taxed in the same bracket of private company at the rate of 30% plus cess and additional surcharge, when applicable. Where as sole proprietorship has less tax implications as the income of sole proprietorship treated as income of an individual.

- OPC as well as Sole proprietorship has the feature of perpetual succession but in case of OPC nominee member will run the business in the event of death or inability of the member and in case of Sole proprietorship this can happen through the execution of ‘WILL’ only. The drawback is that in the event of any miss happening WILL may or may not be challenged in the court of law.

Types of OPC

- OPC limited by shares

- OPC limited by guarantee with share capital

- OPC limited by guarantee without share capital

- Unlimited OPC with share capital

- Unlimited OPC without share capital

Advantages of OPC

The new concept of One Person Company has numerous advantages. The privileges and exemptions enjoyed by One Person Company are:

- Number of members and directors

- Lesser compliance burden

- Limited liability

- Credibility

For more benefits visit Advantages of OPC

Disadvantages of OPC

There are few drawbacks associated with the One Person Company:

- Ownership limitation

- Constraint conversion

- No foreign participation

- Restrict business activities

To know more visit Disadvantages of OPC

Quick view on the various OPC aspects

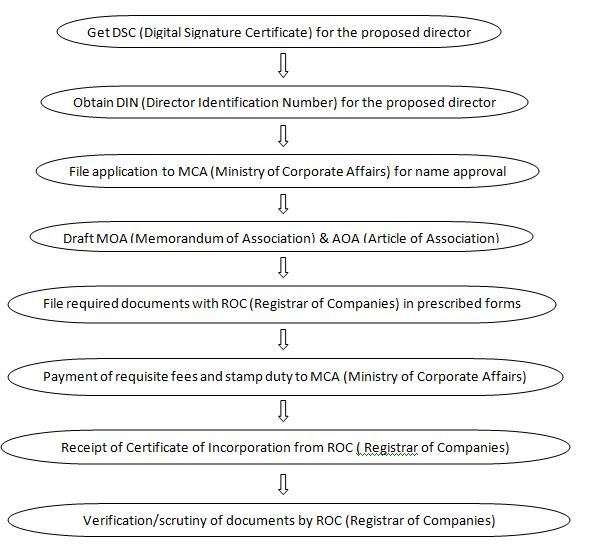

Registration Process of OPC

To know more visit OPC Registration Procedure

Post Registration Compliances

- After incorporation, initial requirement is to obtain PAN and TAN.

- Opening a current bank account with the name of the company.

- Subscription money has to be paid with the company’s bank account.

- Share certificates are issued to the shareholders.

Mandatory compliances

- Filing of annual return and financial statements with the ROC every year.

- If more than one director is there then conduct a board meeting in each half of the calendar year. The gap between the two board meetings should be minimum 90 days.

- Appointing an auditor, if required as per the provision.

To read more visit OPC Compliances

Converting an OPC

One Person Company has the privilege to convert itself into private limited company, public limited company, limited liability partnership. But in case of conversion of OPC into partnership firm or sole proprietorship, law is silent. With the growth of business more requirements are needed which will be achieved by the conversion of the company. However, conversion of OPC into public company or private company possible either voluntarily or compulsorily.

To know more visit Converting an OPC

OPC Comparison

While starting a business the initial step is to choose a right business entity for their business. Broadly, there are five business structures in option that can be choosen. These structures have their own advantages and disadvantages. The decision of choosing the right entity depends on the need of the business and the features of the business. Before making any decision one's should know the difference to compare the different entities.

To know more comparison visit OPC Comparison

Closing an OPC

Every One Person Company registered with the MCA needs to follow certain rules for closure of the company either by way of declaring company defunct or winding up of the company. Proper application has to be filed by the company for closing the company legally by following the prescribed procedure. OPC may wind up either voluntarily or by the order of tribunal.

To know the whole procedure of closing an OPC visit Closing an OPC