Goods & Service Tax (GST) – A Knight Rider for Startups

May 03, 2015 by Titly Chatterjee

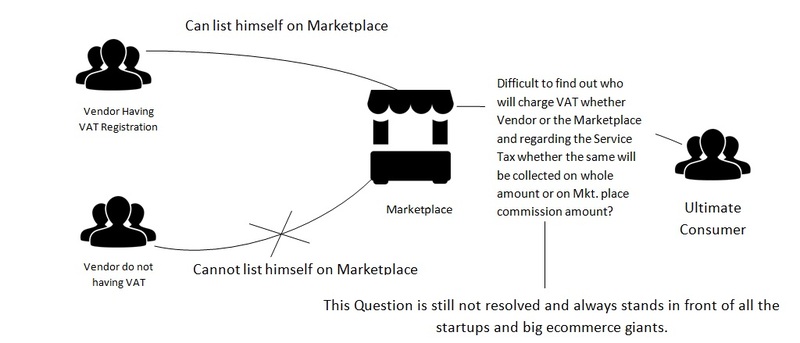

Mr. Ankit Nayar (Changed name), an entrepreneur wants to open his marketplace of luxurious craft items, but the main problem comes to Ankit is how he will list vendors on its marketplace who do not have their VAT/Service tax Registration. And if he list vendors who have their VAT registrations in their names then there is one more problem comes that on whose name the VAT is collected whether on Market Place Name or on the name of Vendor.

Let us, Understand this situation by the help of a diagram:

There is always an ambiguity about this dual tax structure i.e. VAT (State level Taxation) and Service Tax (Central Level Taxation).

Resolution of this Question

On 20th December, 2014, the govt. of India takes another step ahead in position to make its campaign “Make in India” a grand success by introducing GST in Lok Sabha. The FM Mr. Jaitley, introduces this transparent tax system by saying that it is a win win situation for both central & state but in actual it means that it is good for all includes government, sellers and consumers.

It is said that, the hardest thing to understand is tax but now coming of this tax system the quote has to be changed by replacing the word hardest by simplest.

With the coming of GST,(a single tax system), the vicious circle of taxes has been moved out.

Prices got down:

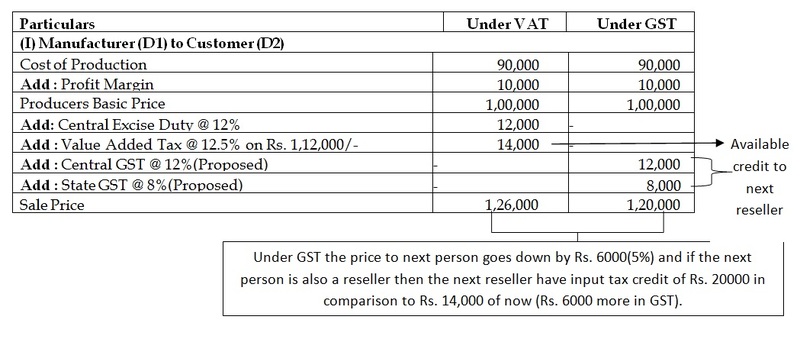

It may be explained by an illustration:

The proposed GST will drive down the price by 7-8% which is increased due to dual taxation and give relief to startups burdened with complying with multiple taxations prevalent in the country.

How GST will help?

GST means Goods and service tax, a single tax system for all the level of taxes whether central or state. substitutes VAT at state level and Service Tax and Excise at Central level by applying SGST and CGST.

In this scenario, there is no requirement of taking different, taxation registrations as now we have to required only requirement is to list and clarify that what are we going to provide i.e. whether we are service providers or manufacturers or traders, according to which the rate slab provided to us.